Ukraine Update: Day 145

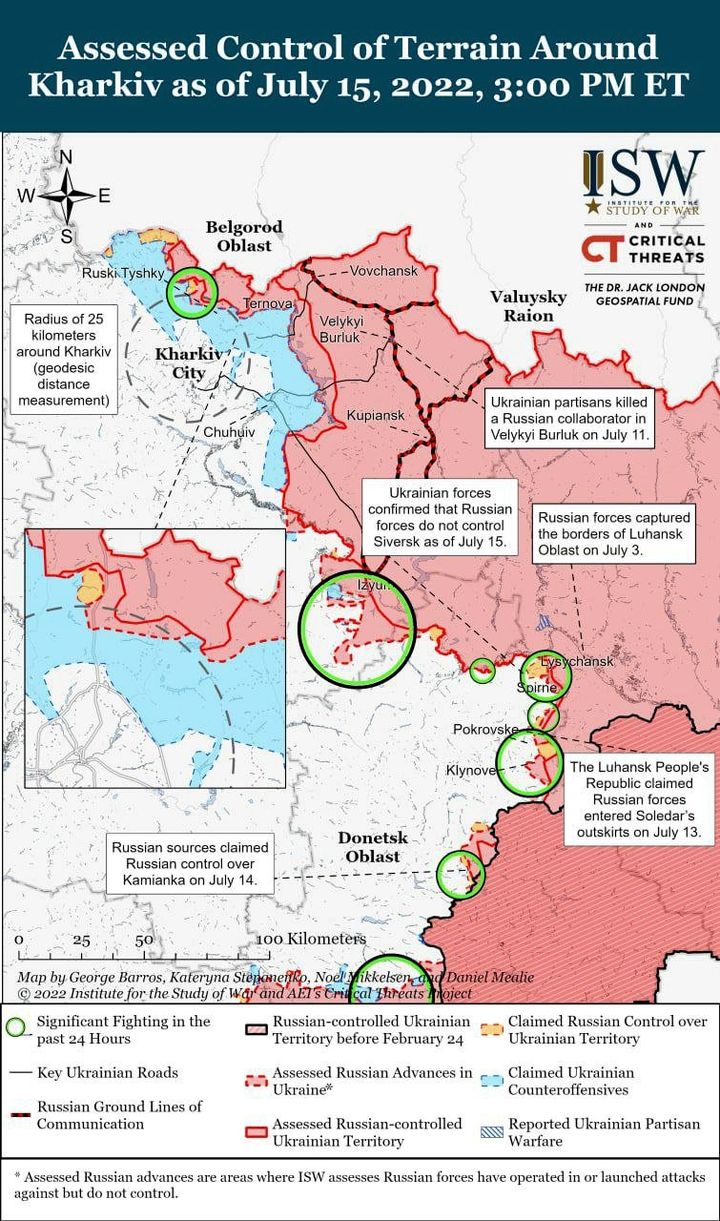

This past week hasn’t been one characterised by manoeuvre warfare and major changes on the map: The Russians took what they called an operational pause. This was mainly dictated by two factors: Troops exhausted after their months-long campaign in the Luhansk Oblast, culminating in the Russian capture of Severodonetsk and Lysychansk, and Ukrainian artillery actively engaging Russian command centres and ammo and fuel dumps behind the front which has hampered Russian shell supplies to its artillery units.

“Frontline” Russian troops cycled out of the combat zone for 5 to 7 days and are now slowly trickling back toward the front.

It does not mean it has been a quiet week for the Ukrainian side: Massive Russian strikes were reported on Kharkiv, Nikolayev, Dnipro, Vinnitsa, Odessa, and Nikopol.

Nikolayev, Dnipro, and Odessa were particularly targeted. The Russians used a combination of ballistic missiles and cruise missiles to hit Ukrainian infrastructure, manpower, and war stocks: Barracks and bases, accommodation blocs, warehouses, factories, depots, and dumps as well as bridges and railway nodes. Russian activity peaked at some point with over 40 missiles impacting within Ukraine inside 24 hours.

Russian Advances and Tactics

Seversk, Slavyansk, Kramatorsk, Bakhmut, and Nikolayev have also been shelled daily.

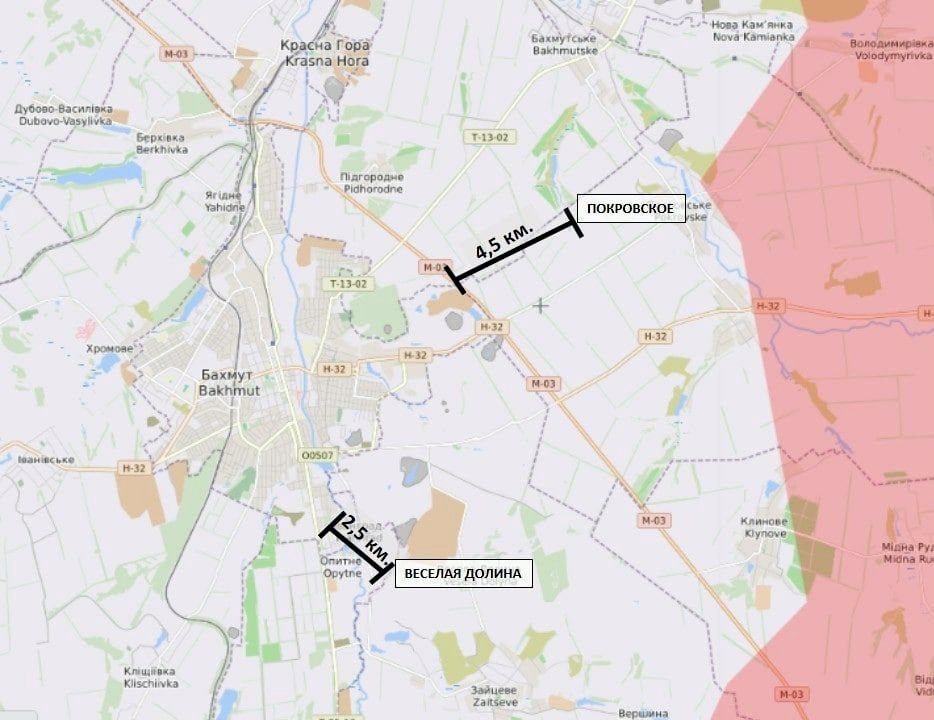

Russian forces advanced toward Seversk and gained a foothold in the town’s eastern edges. No attempt was made to push inside Seversk. It seems Russian forces are instead trying to flank the town by the North and South in order to gain control of the heights surrounding the settlement and force a Ukrainian withdrawal. Russian forces have also arrived at the periphery of Soledar and have improved their position North of Slavyansk and South-East of Bakhmut. So definitely no Blitzkrieg there, but a consolidation of gains and reorganisation for an upcoming offensive in the region.

It is also clear that Russian forces are looking at ways to respond to Washington having provided HIMARS to Ukraine. This “long-hand” capability has given the Ukrainian side the ability to hit Russian logistics and command nodes far behind the front.

The first Russian answer was to bring in six Tochka-U launchers to Ukraine. The convoy was spotted earlier last week near the Lutugyne bus station in the Luhansk region. Those mobile (and amphibious) SRBM can launch missiles mounted with a variety of warheads to ranges up to 185km. The Soviet era Scarab is probably not a HIMARS beater, definitely not in terms of accuracy, but those 6 launchers will provide a mobile strike package to Russian troops that are bound to deliver powerful blows to Ukrainian infrastructure and positions. They will also pose a threat to Ukrainian artillery and MLRS. There are rumours those Tochkas have already been put to use in the Kherson area, hitting Ukrainian logistics and troops’ concentration in Nikolayev.

Countering HIMARS

The second Russian step in countering HIMARS has been the increased use of Russian loitering munitions: The KUB and Lancet-3. But those are still in the development process and have therefore had a limited impact on the battlefield and a high rate of failure…

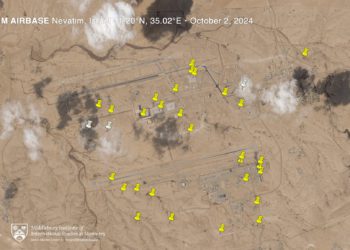

Which brings us to the third step undertaken by the Russians to combat the HIMARS: According to US national security adviser Jake Sullivan, Russian representatives have visited the Kashan Iranian Airbase twice in the past 30 days. The visits seem to have coincided with the presence of Shahed-191 and Shahed-129 drones at the airfield. US sources agree that Iran might be on the cusp of providing Russia with several hundred UAVs, including attack capable ones. While Moscow took the lead in Electronic Warfare and jumped on the reconnaissance UAV bandwagon earlier on, Russia still lags behind in the field of attack UAVs. It is therefore perhaps not surprising to see Russia shop for such capabilities. The Shahed 129 has a range estimated at between 200km and 400km and carries 4 projectiles. The Shahed 191 has a cruising speed of 300 km/h, an endurance of 4.5 hours, a range of 450 km, and a payload of 50 kg (two projectiles carried in internal bays). This would be the perfect platform to loiter above the Ukrainian rear area and hunt for HIMARS and other targets of interests.

Western Military Aid and Challenges

Ukrainian President Zelensky has apparently ordered the liberation of the South of Ukraine. Russian MoD Shoigu has ordered all Russian and separatist units to step up offensive operations across all fronts.

Spain has announced it will hand over to Ukraine 10 Leopard tanks and 20 armoured vehicles pulled out of storage.

Poland has started to deliver some of its PT-91 (T-72) tanks to Ukraine.

Washington has apparently delivered the first batch of M270 MLRS to Ukraine. US military aid to Kiev since February now amounts to $7.3 billion.

Italy might no longer be in a position to provide further military assistance to Ukraine: The Italian government has fallen and while the Italian president has refused to accept his prime minister’s resignation, the current government is stuck in a caretaker role and cannot take decisions such as providing military aid to a third country.

Economic and Industrial Implications

In Berlin, there is a consensus that Germany cannot “plunder its own military” for the sake of Ukraine as it needs those platforms for its own defence. There is now a palpable worry that the West might not be able to sustain Ukraine’s current rate of expenditure on both platforms and ammunition indefinitely. Raytheon has warned it will “take time” to manufacture Stinger MANPADS to replace the 1,300 units handed over to Kiev. France has handed over 18 Caesar SPGS to Kiev (1/4 of the total number operated by France itself) but Nexter has stated it will take them 18 months before they can start manufacturing new ones. NATO, with a combined Defence budget of $1.2 trillion, has problems keeping up with the sustainment needs of a conventional war in its periphery. 30 countries with a combined GDP of $18.35 trillion (21% of the world) have woken up to discover they have an atrophied defence industry incapable in its current state to produce modern fighting platforms and ammunition in high volumes. Total annual US production of 155mm artillery shells, for example, would last less than two weeks of combat in Ukraine. In the same scenario, the UK’s ammunition stockpile would run out after eight days. In the West, we have seen several waves of mergers and acquisitions in the defence sector since the early 1990s. These big conglomerates have become very good at churning money and producing profits for shareholders through a combination of eye-watering pricing policies and lean manufacturing processes. What they have lost, with each plant/assembly line they shut down, is volume capabilities/output. In the US, the Pentagon currently works with just five main defence contractors; in the 1990s, the number was 51.

There is no doubt that if the West puts its mind and industrial might to it, it could easily out-produce Russia. But EU and US citizens are currently more preoccupied by the current energy crisis and inflation/cost of living. Something that is increasingly in the minds of many Western politicians and leaders. Meanwhile, in Russia, there are signs that the Russian economy and industry are being slowly prepared to switch to a wartime economy if the need should arise.

Casualties and Strategic Plans

Ukrainian Defence Minister Oleksiy Reznikov said in an interview in June that Ukraine has lost “tens of thousands” of men. He stated that the actual death toll was higher than any official estimate and that “He hoped that it was under 100,000”. This is the same minister who had previously announced plans for a summer counter-offensive against Russian forces to recover lost territory. He very recently stated that there weren’t any such plans and that he was misunderstood. Truth? Bluff? Double Bluff? Who knows…

-RBM.